Our strategy

Our strategy

Our primary focus

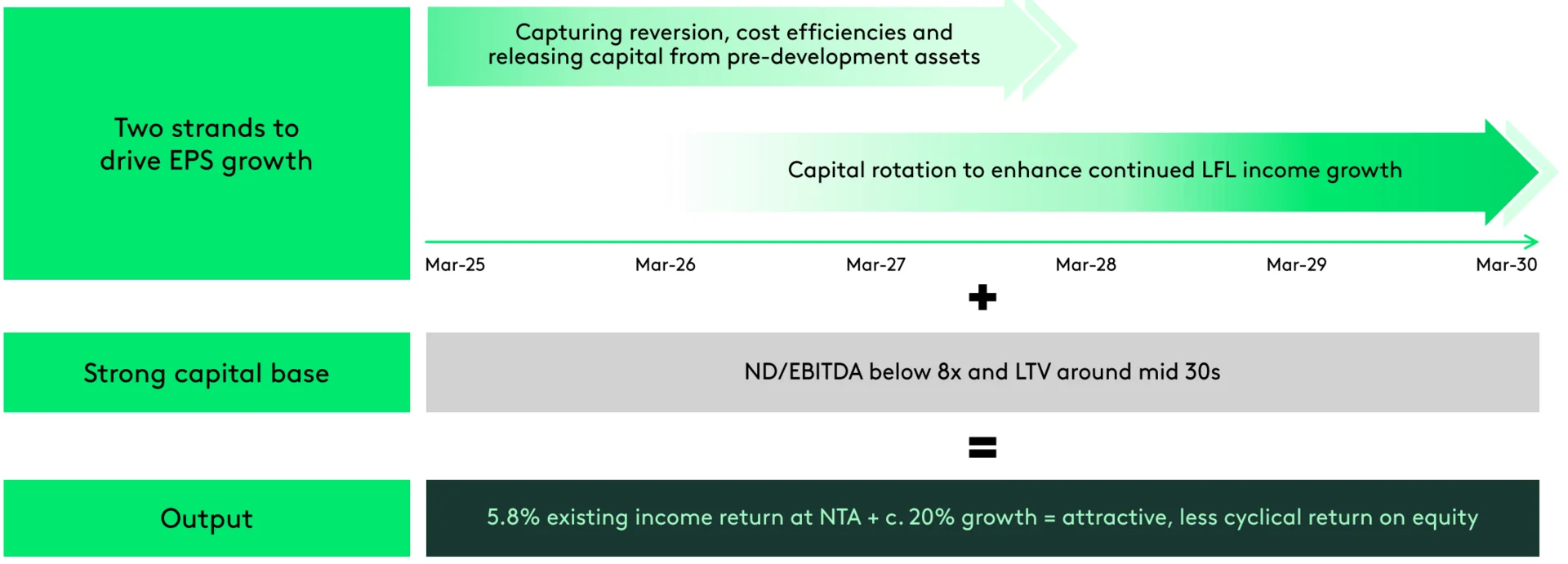

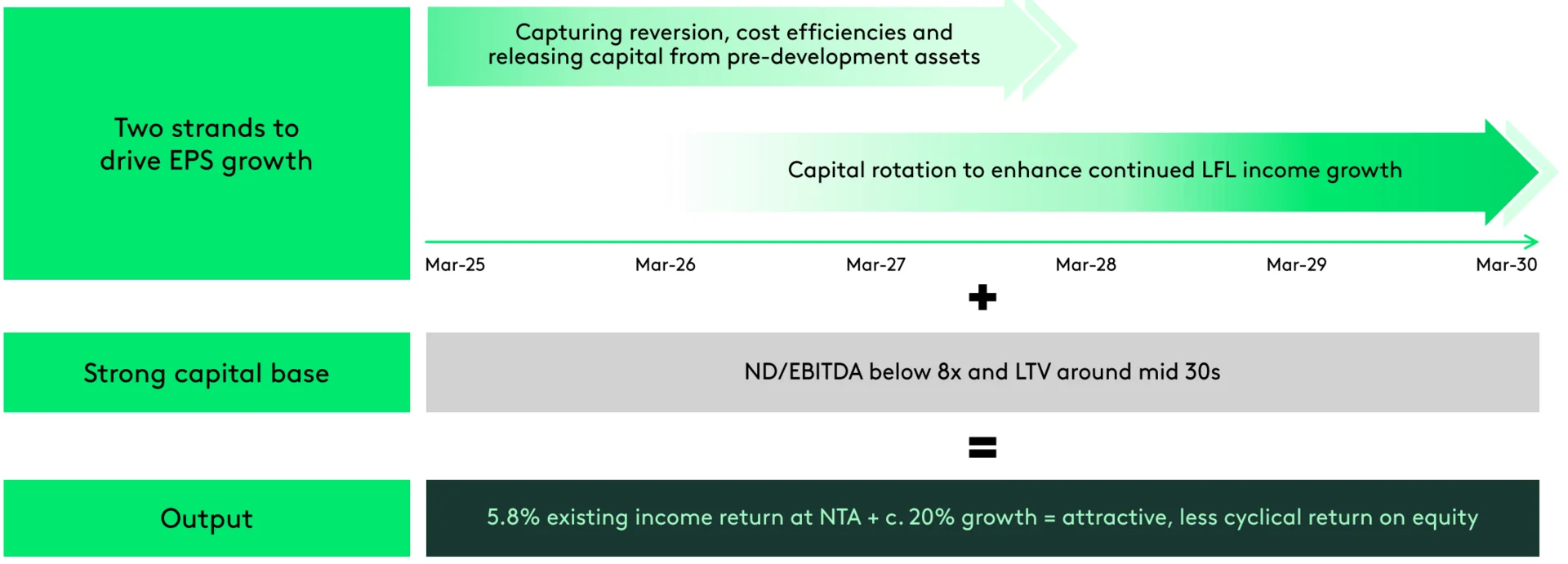

Delivering sustainable income and EPS growth

Our places

Office-led

Retail-led

Residential-led

Our strategy

Our strategy

Delivering sustainable income and EPS growth

Our places

Office-led

Retail-led

Residential-led